Gasoline prices are subject to numerous factors, and understanding the dynamics behind these fluctuations is essential for consumers and policymakers. In this article, we delve into the primary factors influencing gasoline prices, including the cost of crude oil, refining costs, taxes, and distribution/marketing. We will also explore why gasoline prices vary regionally.

1. Crude Oil Prices:

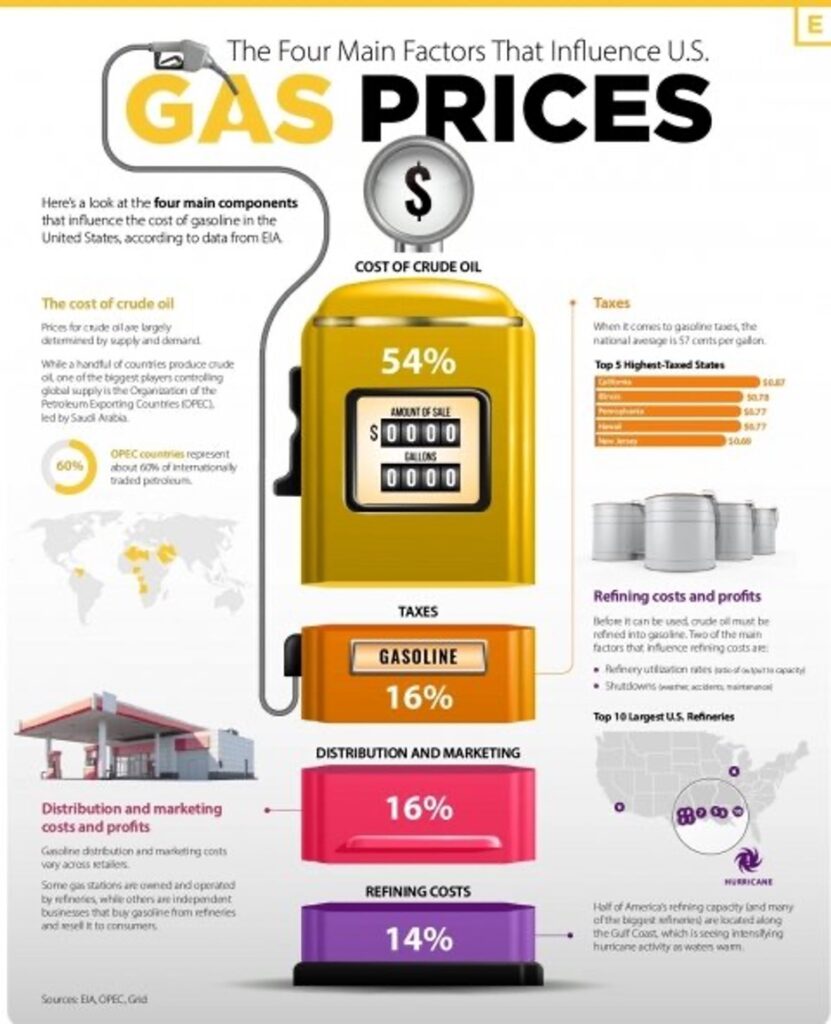

The single most significant factor influencing gasoline prices is the cost of crude oil. This cost is predominantly determined by global supply and demand dynamics. Despite being the world’s largest oil producer, the United States remains a net importer of crude oil, with imports primarily sourced from Canada, Mexico, and Saudi Arabia. Consequently, U.S. gasoline prices are profoundly affected by the global crude oil market.

Geopolitical events and organizations such as the Organization of the Petroleum Exporting Countries (OPEC), led by Saudi Arabia, have a substantial impact on crude oil prices. OPEC, established in 1960, sets production targets for its 13 member countries, and changes in OPEC production historically correlate with oil price fluctuations. OPEC nations account for approximately 60% of internationally traded petroleum.

2. Refining Costs:

Gasoline is derived from crude oil through refining processes, making refining costs a significant component of gasoline prices. The United States boasts numerous refineries, with the largest one owned by Saudi Aramco, processing over 607,000 barrels of oil per day. Refining expenses fluctuate based on factors like the type of crude oil used, refining technology, and regional gasoline specifications.

Refining capacity in the U.S. has not kept pace with demand, with no new refining facilities constructed since 1977. The COVID-19 pandemic exacerbated this issue, causing some refineries to shut down temporarily. This imbalance between refining capacity and demand can lead to price volatility.

3. Taxes:

Taxes play a pivotal role in determining gasoline prices within the United States. On average, gasoline taxes amount to approximately $0.57 per gallon across the nation, though precise amounts vary from state to state. Taxation significantly contributes to the cost of gasoline for consumers.

4. Distribution & Marketing:

The distribution and marketing of gasoline also influence its final price at the pump. This includes costs associated with transporting gasoline from refineries to retail locations, as well as marketing and branding expenses for oil companies and gas station operators.

Why Do Gasoline Prices Fluctuate?

Gasoline prices are subject to fluctuations due to several key factors:

- Supply and Demand: Gasoline prices rise when supply falls relative to demand. This can occur due to factors such as disruptions in crude oil supplies, refinery issues, or interruptions in gasoline pipeline deliveries. Even when crude oil prices remain stable, gasoline prices can still fluctuate due to seasonal changes in demand and gasoline specifications.

- Seasonal Demand: Historically, retail gasoline prices tend to gradually increase in the spring and peak in late summer when people drive more frequently. Conversely, gasoline prices are typically lower in the winter months. Seasonal changes also affect gasoline specifications, as environmental regulations require less evaporative gasoline in the summer.

- Gasoline Inventories: Gasoline inventories act as a buffer against supply-demand imbalances. When unexpected declines in supply occur due to refinery problems, pipeline disruptions, or low imports, gasoline inventories may decrease rapidly, leading to price increases. Regionally, adjustments in gasoline formulations can also impact inventory levels.

Why Do Gasoline Prices Differ Regionally?

Gasoline prices exhibit regional disparities influenced by various factors:

- Distance From Supply: Gasoline prices tend to be higher the farther gasoline must be transported to retail points, as transportation costs increase with distance. Supply sources, including refineries, ports, and blending terminals, play a significant role.

- Supply Disruptions: Events that disrupt gasoline production, such as pipeline disruptions or refinery maintenance, lead to increased competition for available supplies, driving prices up. The ability to transport surplus supplies from one region to another affects price stability.

- Retail Competition and Operating Costs: Gasoline prices at stations often reflect local competition and operating expenses. Fewer gasoline stations in an area may result in higher prices, even for nearby stations. Traffic patterns, rent costs, and supply sources contribute to pricing differences.

- Environmental Programs: Some regions mandate the use of special, reformulated gasoline with additives to reduce emissions. These programs add to the production, storage, and distribution costs of gasoline, impacting prices.

California’s Unique Situation:

California stands out due to its distinct gasoline market:

- Unique Gasoline Blend: California employs a more stringent reformulated gasoline program compared to the federal government. This necessitates specific gasoline blends, limiting the number of refineries that can produce it.

- High Gasoline Taxes: California also imposes higher gasoline taxes compared to most states, contributing to elevated prices.

- Supply Challenges: California’s refineries must operate near full capacity to meet the state’s demand. If multiple refineries face operational issues simultaneously, prices can spike. Additionally, the geographical distance between California and other supply sources can lead to delayed deliveries.

In conclusion, gasoline prices are a result of complex interactions between factors like crude oil costs, refining expenses, taxes, and distribution/marketing costs. These prices fluctuate due to supply and demand dynamics, seasonal variations, gasoline inventory levels, and regional disparities in transportation, competition, and environmental regulations. Understanding these elements is essential for consumers and policymakers navigating the volatile world of gasoline pricing.